Gold and precious metals continue to trade very strongly as we get closer to the end of 2023.

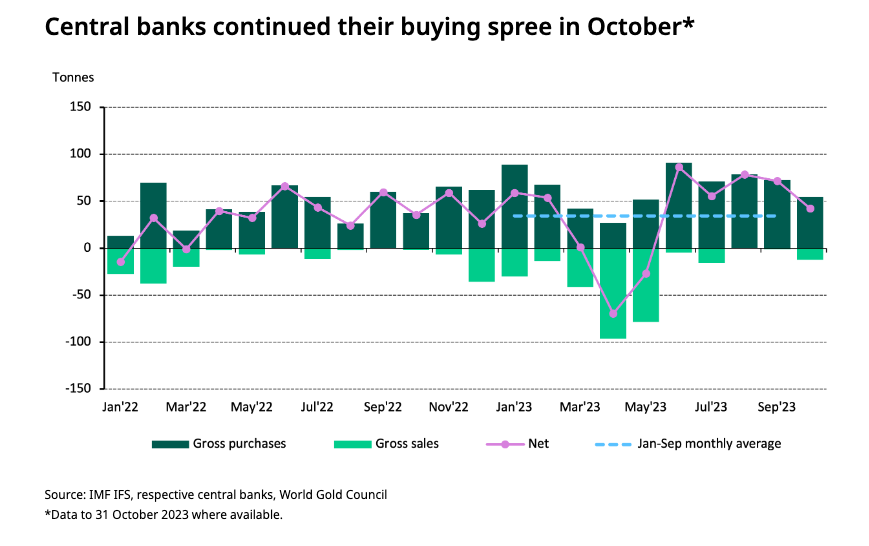

The demand for gold by central banks remains strong, as evidenced by the reported global net purchases amounting to 42 tonnes in October. This figure surpasses the average monthly purchases of 34 tonnes recorded from January to September by 23%.

Interestingly, a global trend of dedollarization continues as an increasing number of countries opt to conduct trade using their local currencies rather than the US dollar. This shift aligns with the ongoing efforts of central banks to develop central bank digital currencies.

Amid these developments, investors globally are turning to gold as a safe haven. This trend is driven by the rapid depreciation of currencies worldwide and the persistently high, and increasingly burdensome, levels of debt in various countries.

Great Pacific Gold | GPAC.V

A company that I have been covering for a while, previously known as Fosterville South, has recently undergone a rebranding and is now called Great Pacific Gold. This change follows a significant acquisition they completed in September, marking a transformational moment for the company.

The company has secured a land position spanning 2,166 square kilometers in Papua New Guinea. This includes a 130 square kilometer project area that is contiguous with, and situated northwest of, the exploration tenements held by K92 Mining Inc and a 614 square kilometer project to the southeast

What distinguishes this development is its significance as a homecoming for the founder of K92 Mining, Bryan Slusarchuk.

He is at the helm of Great Pacific Gold, which is poised to undertake an aggressive program in the country in 2024. In addition to Bryan, K92 Mining CEO John Lewins serves as a director of Great Pacific Gold.

As many readers are aware, K92 Mining is a highly regarded company known for operating a high-grade gold mine in Papua New Guinea. The current market capitalization of the company stands at around CAD $1.5 billion.

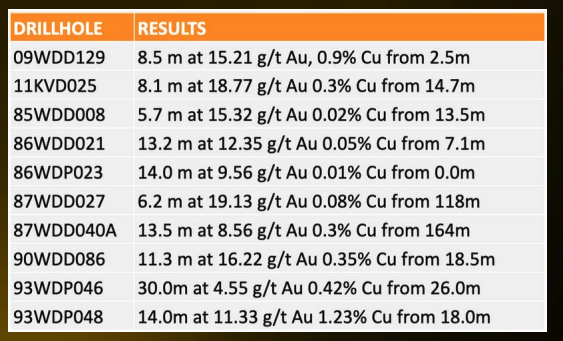

In 2024, one of the key projects the company will focus on is the Wild Dog project. This deposit, discovered in 1983, has shown promise with previous drilling revealing high-grade results. Additionally, there is a substantial inventory of unmined drill intercepts, indicating potential for further exploration.

The Wild Dog fault zone, known for its proven gold mineralization extending over at least 11 kilometers, encompasses the Wild Dog and Kavursuki gold deposits.

Drilling to extend the areas of known mineralization is expected to further enhance the high-grade gold (Au), silver (Ag), and tellurium (Te) resources in 2024.

The Papua New Guinea (PNG) acquisition complements three high-grade gold projects in the Fosterville area of Victoria, Australia. This includes a substantial land package with a history of high-grade gold production, located to the south of and adjoining the tenements of Agnico Eagle in Fosterville.

I will provide an update on the company in early 2024, however, today I am pleased to have the opportunity to be joined by the CEO, Bryan Slusarchuk, who will provide an update on the company as we approach the new year.

Alex Deluce:

Thank you, Bryan, for sharing updates with the Gold Telegraph community. Since our last interview, significant changes have occurred within the company. Could you elaborate on these developments, particularly your return to Papua New Guinea?

Bryan Slusarchuk:

Thanks Alex, it has been a transformational several months for the company with our emergence as a significant exploration player in PNG and very recently, a new very high-grade gold discovery in Australia.

PNG is a place that is very close to my heart ever since my first visit in 2014 when we went to look at the then Barrick Gold asset that ultimately launched K92 Mining. K92 has been a very remarkable situation, and the company is currently the largest explorer in the country and has had a lot of success via both exploration and production. In fact, the company now has approximately 1650 employees, and the Kora North discovery was ultimately awarded the Best Global Discovery for the year it was made.

Great Pacific Gold (GPAC) has acquired a commanding 2166 sq km land position in the country, consisting of three separate projects including a 130 sq km parcel contiguous with and immediately north-west of the K92 Mining tenements. Two of the projects we have within GPAC have had quite a bit of past work done at very shallow levels including some mining operations but have never been looked at in any meaningful way at depth. We have a host of target types on these projects including both high grade epithermal veins and porphyry. Drilling is planned for Q1 2024 and we are doing a lot of preparation work now. PNG is known as the “Land of Giants” in the mining world for good reason. These targets are not only high grade, but they also host serious size and scope potentially. We have had a lot of success in PNG in the past as explorers and we rate these exploration projects very highly on a global scale.

Alex Deluce:

The company’s assets in Papua New Guinea, such as the Wild Dog Project, Arau Project, and the Kesar Creek Project, with Wild Dog showcasing promising grades from historical drilling. Could you share the timeline for when drilling will commence and the projected drilling depth in metres?

Bryan Slusarchuk:

We will be drilling at the Arau Project in Q1 2024 and we would like to be drilling at the Wild Dog Project in Q1 2024 as well. Kesar Creek is the earliest stage of the three projects, and we are immediately starting a blanket soil Geochem program there as to generate drill targets. The entire year will be very drill-centric in PNG and should expose investors to an opportunity at discovery in amazing geological settings. The initial drill program phase at Arau will be approximately 2500m and then will grow from there.

Alex Deluce:

You’ve achieved remarkable success in the country since founding K92 Mining in 2014. Could you tell us more about your team members who also have significant experience working in the country?

Bryan Slusarchuk:

As co-founder and former President of K92 Mining, I’ve seen first had what an incredible jurisdiction PNG is. With hard work and good science, all stakeholders have benefitted significantly through the exploration success that K92 has had in PNG.

John Lewins, K92 Mining’s CEO, has been the driving force behind that success and we are fortunate to have John as a Director on Great Pacific Gold.

Chris Muller, K92’s Executive VP Exploration was the QP on our last Great Pacific Gold news release related to PNG and has been working in PNG for approximately 18 years now on a variety of successful exploration projects. Doug Kirwin, an Advisor to GPAC, also has a lot of experience in the country. We are well positioned to execute in PNG and have built some great relationships in-country over the past 9 years of working here.

Alex Deluce:

The company boasts an impressive and substantial land package in Australia. Could you discuss the recent discovery made there, which includes a notable result of 5 meters at 166.35 g/t gold, including 2 meters at 413 g/t gold, from the final drill hole of the 2023 drill program in Victoria?

Bryan Slusarchuk:

On the last hole of 2023 and perhaps what would have been the last hole drilled on the Comet Prospect had the intercept not occurred, a very significant high grade gold discovery was made.

The grade of the discovery is obviously spectacular but what people are figuring out is that even more important than the bonanza grade is the structural setting where this discovery was made. It is at the juncture where the west dipping faults intersect the anticline, and for investors who know Victoria geology and the Fosterville story, this is very important.

Based on what Rex Motton and his technical team saw in the near surface reconnaissance drilling and based on the knowledge they had as to where the anticline existed and the faults existed, they drilled a hole and made the discovery at the location they believed had the best potential for a Fosterville type discovery. Time will tell how this situation develops but getting a bonanza grade hit with more than 400 g/t Gold with very nice grade distribution in that setting is nothing less than an amazing start.

Alex Deluce:

Lastly, Bryan, could you highlight some key catalysts that investors should watch for in 2024? Given the company’s strong cash position, it seems likely to be a busy year for you and the team. Could you elaborate on this?

Bryan Slusarchuk:

In addition to have some incredible projects in both PNG and Australia, a brand-new high-grade gold discovery in Australia and a technical team with a proven track record of shareholder wealth creation, we have less than 85 million shares out and approximately $13 million in cash on hand. If people like the story, and its tough not to really like this geologically, they know they must go to the tape if they want exposure to the name. This has the potential to create some explosive share price growth.

We have a catalyst rich Q1 planned with drilling in PNG and drilling in Victoria. We will be following up on extensive near surface historic work in PNG and on the new Comet discovery in Victoria. The catalysts therefore will be all about drill results over the next few months. This discovery hole has just occurred, it was the last hole of the year we drilled, and this is an evolving situation but no doubt an amazing way to end the year and to start off 2024.

Legal Notice / Disclaimer

The Gold Telegraph, goldtelegraph.com, hereafter known as Gold Telegraph. Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the Gold Telegraph Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this Gold Telegraph website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it. Any Gold Telegraph document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold Telegraph has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Gold Telegraph makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold Telegraph/Author only and are subject to change without notice. The Gold Telegraph/Author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, The Gold Telegraph/Author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this The Gold Telegraph/Author report. The Gold Telegraph/Author is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading The Gold Telegraph/Author articles, you are acting at your OWN RISK. In no event should The Gold Telegraph/Author be liable for any direct or indirect trading losses caused by any information contained in The Gold Telegraph articles. Information in Gold Telegraph/Author articles is not an offer to sell or a solicitation of an offer to buy any security. The Gold Telegraph/Author is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions The author does own shares of Great Pacific Gold (TSX-V:GPAC. Great Pacific Gold is a paid advertiser on the Gold Telegraph.