Here is a brief recap:

In just three months in 2021, Brazil’s gold reserves surged nearly 100%.

Today it holds nearly 130 tons.

In March 2022, Brazil’s central bank reported that the country made a noteworthy shift in its foreign reserve strategy.

The central bank said it quadrupled its foreign reserves in Chinese yuan while reducing its holdings of U.S. dollars and euros in 2021.

Towards the end of 2022, news surfaced that China would be importing corn from Brazil in a bid to diversify its sources and lessen its reliance on the United States, which happens to be the largest corn exporter in the world.

In January, China emerged as the largest importer of corn from Brazil. It is worth noting that Brazil is currently the third-largest producer of corn globally.

Earlier this year, the President of Brazil hinted at the potential creation of a shared currency for both BRICS and MERCOSUR, which could be used in mutual settlements.

After that?

The world learned that Argentina and Brazil are discussing the possibility of launching a common currency. The move is seen as a part of their collaborative efforts to minimize dependence on the U.S. dollar.

These are the two largest economies in South America.

This brings us to the last 24 hours:

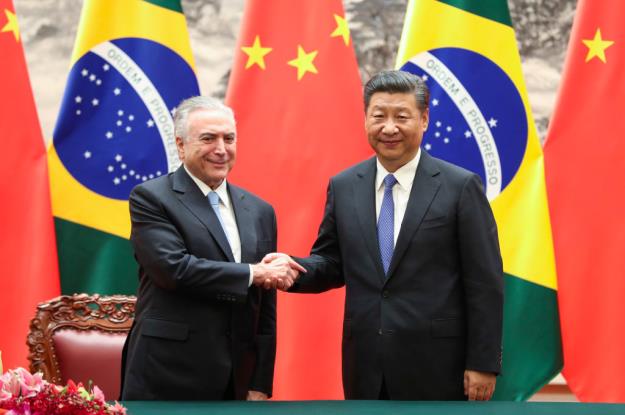

Brazil and China have struck a deal to ditch the U.S. dollar in favour of their own currencies in trade transactions.

This agreement will allow direct trade and financial transactions between China and Brazil, where the two nations can transact using their respective currencies, yuan and reais, without having first to convert their currencies to U.S. dollars.

The trend is now very real and open for everyone to see.

It is going to be a wild ride.